vanguard tax-exempt bond index fund investor shares

The fund is intended for California residents only. The income is expected to be exempt from both federal and California personal income taxes.

7 Best Bond Index Funds To Buy

269 Average Muni New York Long Fund.

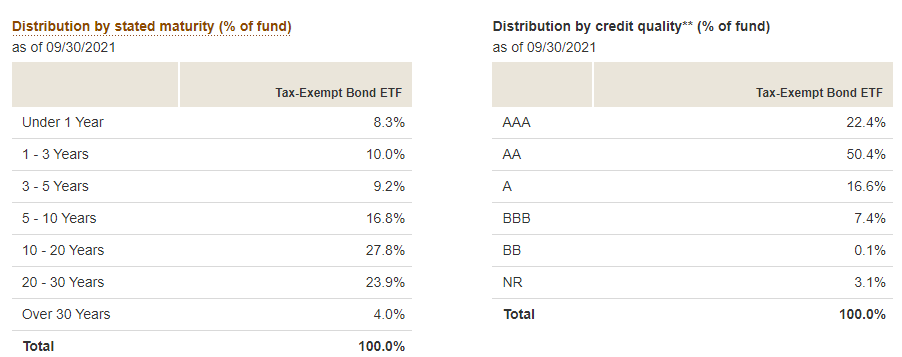

. Although the fund has no limitations on the maturities of individual securities its dollar-weighted average maturity is expected to be between 10 and 25 years. Important tax information for 2021 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns. Vanguard California Intermediate-Term Tax-Exempt Fund seeks moderate current income by investing at least 80 of its assets in municipal securities exempt from federal and California taxes.

Vanguard core bond fund will offer investor shares with an estimated expense ratio of 025 and. NY LT Tax-Exempt Investor. The fund also may invest up to 20 in California alternative minimum tax bonds.

30-Day Sec yield of 414Vanguard Mortgage-Backed Securities ETF NASDAQVMBS - 00960. Vanguard Tax-Exempt Bond Index Fund ETF Shares. These municipal bonds are generally of intermediate maturity.

Vanguard Limited-Term Tax-Exempt Fund Admiral Shares since 5102017 Vanguard Tax-Exempt Bond Index Fund Investor Shares since 8212015 Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares since 6282013 Vanguard New York Long-Term Tax-Exempt Fund Investor Shares since 6282013. The Investment Seeks A Moderate And Sustainable Level Of Current Income That Is Exempt From Federal Personal Income Taxes. Vanguard High-Yield Tax-Exempt Fund.

The fund is conservatively managed emphasizing well-diversified highly rated municipal bonds. Selection within the transportation revenue sector detracted from performance as did both allocation and selection within the hospital revenue sector. For the quarter ended June 30 Vanguard Long-Term Tax-Exempt Fund underperformed both its benchmark the Bloomberg Municipal Bond Index 294 and the average return of its peers 422.

04071986 Returns before taxes-1075-061. VWSTX - Vanguard Short-Term Tax-Exempt Fund Investor Shares Vanguard Advisors. The fund has no limitations on the maturity of.

As of November 2021 the fund invested nearly 45 of its assets in bonds issued by municipalities in New York 214 California 145 and Texas 88. Returns after taxes on distributions-1094-078. Get Vanguard Tax-Exempt Bond Index Fund ETF Shares VTEBNYSE Arca real-time stock quotes news price and financial information from CNBC.

Vanguard Wellington Fund Investor Shares. The indexs sector exclusions steer. California Intermediate-Term Tax-Exempt Fund seeks to provide a higher level of current income than shorter-term bonds but with less share-price fluctuation than longer-term bonds.

Vanguard New Jersey Long-Term Tax-Exempt Fund seeks current income by investing at least 80 of its assets in securities exempt from federal and New Jersey taxes. Vanguard High-Yield Corporate Fund Investor Shares. The fund invests in investment-grade municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from.

Vanguard Long-Term Corporate Bond ETF NASDAQVCLT - 03250. Tax-exempt interest dividends from these funds as reported on Form 1099-DIV Box 11 are taxed differently at the federal. For most actively managed funds an investor.

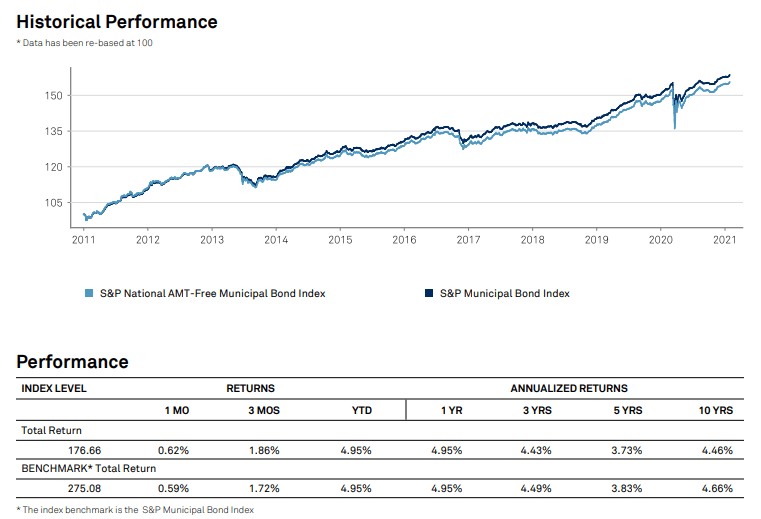

Vanguard Tax-Exempt Bond Index Fund seeks to track the SP National AMT-Free Municipal Bond Index which measures the performance of the investment-grade segment of the US. Under normal circumstances at least 80 of the funds assets will be invested in securities whose income is exempt from federal and Pennsylvania state taxes. Vanguard Short-Term Tax-Exempt Fund Investor Shares VWSTX - Find objective share price performance expense ratio holding and risk details.

1-yr 3-yr 5-yr 10yr. Vanguard Limited-Term Tax-Exempt Fund Admiral Shares since 5102017 Vanguard Tax-Exempt Bond Index Fund Investor Shares since 8212015 Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares since 6282013 Vanguard New York Long-Term Tax-Exempt Fund Investor Shares since 6282013. These municipal bonds are generally of intermediate and long maturity.

30-Day Sec yield of. 245 Returns after taxes on distributions and sale of fund shares-528.

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Vanguard Advisors

Sa303 Investing Basics Stocks Bonds Mutual Funds Etf S Finance Investing Money Management Advice Investing

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

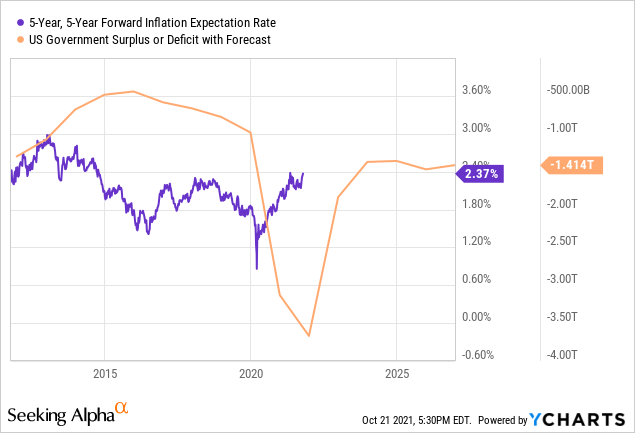

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

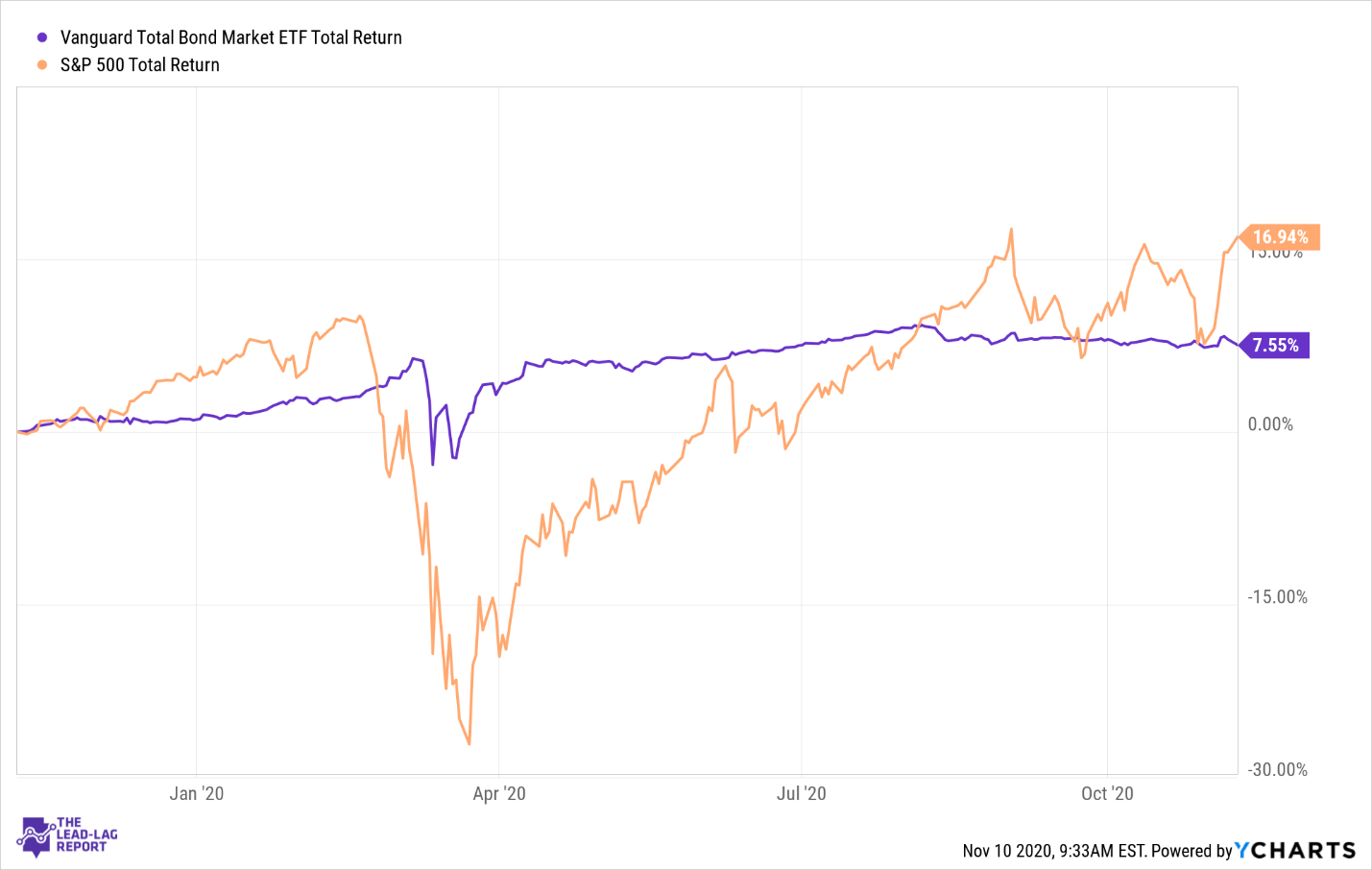

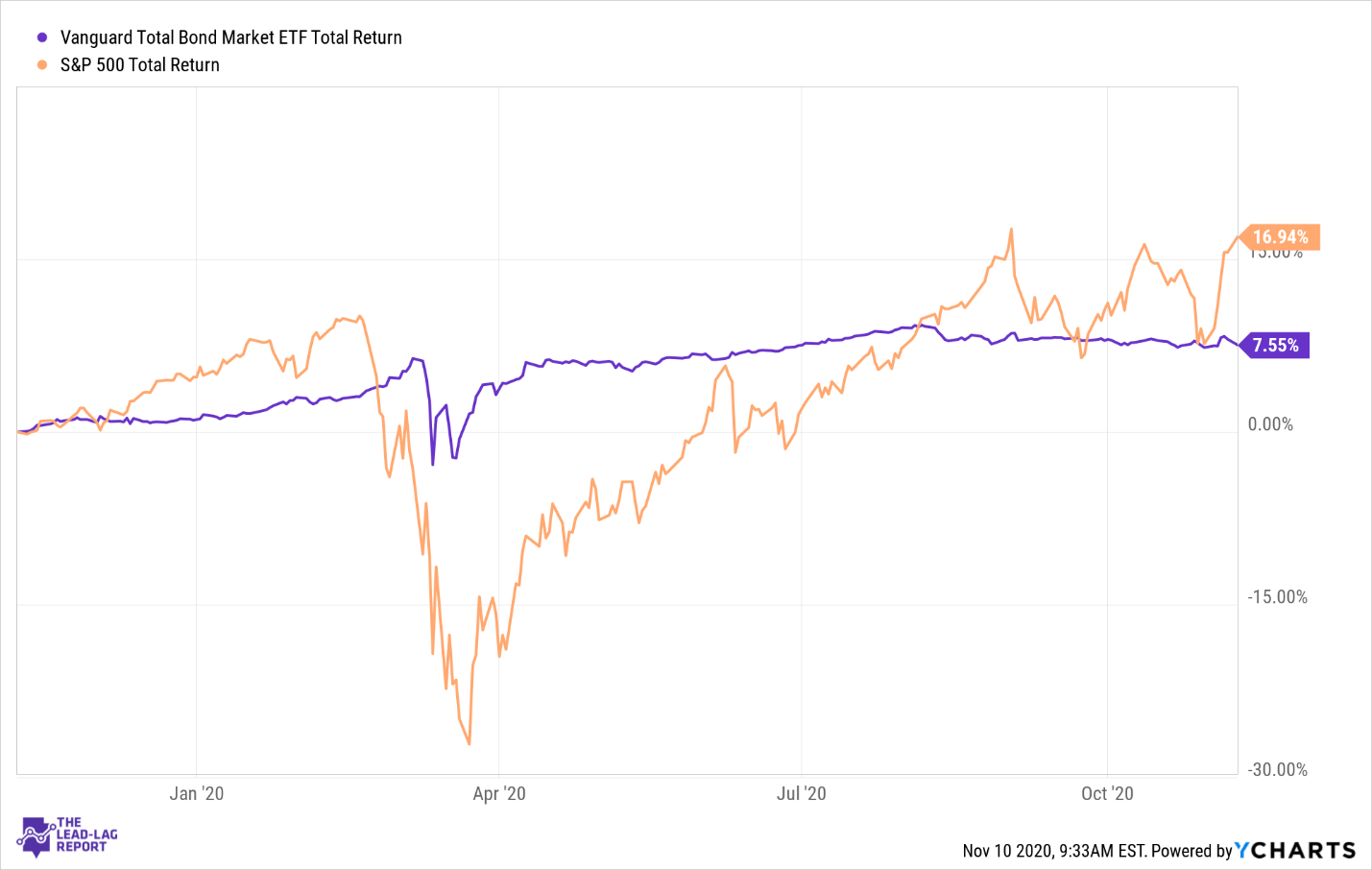

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Ownership In Us604129q588 State Of Minnesota 13f 13d 13g Filings Fintel Io

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Vanguard Advisors

Portfolio Makeover 4 Moves To Consider In 2020 Capital Group Dow Jones Index Bond Funds Capital Market

Vnytx Vanguard New York Long Term Tax Exempt Fund Investor Shares Vanguard Advisors

Investment Tracker Investing Stock Market Stock Market Investing